Workforce Solutions administers Child Care Services (CCS) funding to help parents pay for child care while they work, go to school, or participate in job training. Examples of parents who are eligible for assistance include:

-

Parents who are receiving Temporary Assistance for Needy Families (TANF).

-

Parents who have recently stopped receiving TANF benefits because of earned income or time limits.

-

Parents in job training programs such as Choices, Supplemental Nutrition Assistance Program (SNAP) or those offered through the Workforce Innovation and Opportunity Act (WIOA).

-

Parents that meet income guidelines* and need help paying for child care, so they can continue to work or attend training.

-

Teen parents from families that meet income guidelines* and need child care to attend school.

-

Parents that meet income guidelines* and have children with disabilities.

As with other types of financial aid, CCS requires families to meet income guidelines. If you are eligible and qualify for services, you may be responsible for a portion of the cost of child care depending on your income and the number of children needing care.

Parents receiving child care assistance are free to choose which child care center their child will attend. In certain circumstances, it may also be possible to select a relative care provider.

For more information, please see the Questions and Answers listed below.

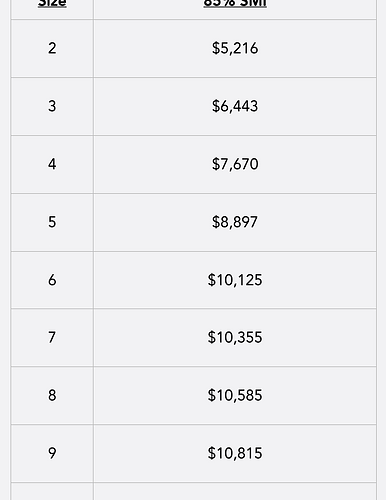

*For the purposes of CCS eligibility, families must be earning 85% of State Median Income or less. You can find the Income Guidelines in the "Do I qualify for Childcare Assistance?" below.

Do I qualify for Child Care Assistance?

To find out whether you qualify for child care assistance, please answer the following questions:

-

Do you live in Dimmit, Edwards, LaSalle, Kinney, Maveric Real, Val Verde, Uvalde or Zavala county?

-

Are you (and your spouse, if applicable) employed, in school or in training for a minimum of:

-

25 hours per week for a single parent household, or

-

50 hours per week for a two parent household?

-

-

Is your child under 13 years of age or a child with special needs under the age of 19?

-

Are your children U.S. citizens or legal immigrants?

-

Does your household meet the income guidelines for your family size? (See below for Income Eligibility Guidelines.)

Maximum Gross Income Eligibility for Child Care Services – Effective

October 1, 2023 to September 30, 2024

If you answered "yes" to all of the questions, you may be eligible for child care assistance. For more information, please see the "How do I Apply?" below.

How Do I Apply?

If you believe you may be eligible for child care assistance, the next step is for you to complete an application and other required forms, submitting all documents to Child Care Services (CCS).

A copy of the following documents must be included with your application package.

Personal Identification for each household member:

-

Birth Certificate

-

Social Security Card (optional) and

-

Valid Driver License or Picture ID for Parents.

Income Information - If employed: If employed: Copies of check stubs for each parent in the household for the last 3 months (Pay Frequency: weekly-13 check stubs, bi-weekly-7 check stubs, twice a month-6 check stub, and monthly-3 check stub)

For New Employment: Must obtain and complete an Employment/Income Verification Form by contacting a Child Care Specialist.

For Self-employment/Cash Payments

Household Income - Household Income - Proof of ALL Household Gross Income including: bonuses, tips, commission, incentive, Net Earnings from Self-Employment, Retirement Benefits, Taxable Capital Gains, Dividends and Interest, Rental Income, Income from Estate and Trust Funds, Workers Compensation, Death Benefits, and Disability Payments, including Social Security Disability Insurance (SSDI) payments, Lottery Winnings of $600.00 or greater, or Spousal Maintenance or Alimony must be included.

If Attending School or Training:

-

Current school schedule and current transcripts

If attending High School, a GED program or a Vocational school:

-

Current letter of enrollment from the school, and

-

School or Training Schedule Verification Form

Notice: All required documents and forms must be completed and submitted together in order for the application to be processed.

Can I Choose My Child Care Provider?

With the Child Care Services (CCS) program, parents choose which child care center their child will attend.

Workforce Solutions assists parents in making child care decisions based on the services offered, hours, fees and ages of children accepted by licensed child care providers that offer CCA-funded care in Dimmit, Edwards, LaSalle, Kinney, Maveric Real, Val Verde, Uvalde and Zavala counties.

The Child Care Licensing Website identifies those child care providers who are licensed with the Texas Department of Family and Protective Services.

Parents are also given the option of selecting a relative to care for their children.

Finally, the Child Care Consumer Education Guide presents valuable information to assist you with your selection.

Who is Eligible for Relative Child Provider Services?

Subject to certain restrictions, parents are given the option of selecting a relative to care for their children.

In order for a family member to qualify as a Relative Child Care Provider with CCS, the individual must meet the following requirements.

A relative child care provider must be an individual who is at least 18 years of age and is (by marriage, blood relationship, or court decree) related to the child.

A "relative" must be the child’s grandparent, great-grandparent, aunt, uncle, or sibling (only if the sibling does not reside in the same household as the eligible child).

Relative care may ;be provided either in the child's own home (in-home child care), or in the relative's own home, which is not the child's home.

Relative in-home child care is allowed for the following:

-

A child with disabilities as defined in §809.2(6), and his or her siblings;

-

A child under 18 months of age, and his or her siblings;

-

A child of a teen parent; and

-

When the parent's work schedule requires evening, overnight, or weekend child care in which taking the child outside of the child's home would be disruptive to the child.

In order for a relative child care provider to be eligible for reimbursement, the following rules apply:

-

Providers caring for a child in the relative's own home, which is not the child's home, shall list with Department of Family Protective Services;

-

Providers caring for a child in the child's own home (in-home child care), shall not appear on the Texas Department of Public Safety's (DPS) Sex Offender Registry.

Required Documents for relative child care providers:

-

Social Security Card

-

Driver License or Picture ID

-

Current Utility for Parent and Provider

Contact Phone Numbers:

1-800-888-9436